Decentralized Finance, or DeFi, is not just a buzzword; it’s a transformative force in the financial sector. Built on the robust foundation of blockchain technology, DeFi bypasses traditional intermediaries, offering a more direct and democratized approach to financial transactions. As it continues to gain traction, its ripple effects are felt globally, prompting both excitement and apprehension among stakeholders.

The rise of DeFi signifies a paradigm shift. From Wall Street to remote villages in developing nations, the promise of a more inclusive and efficient financial system is alluring. However, with its nascent stage comes the inevitable challenges of understanding, acceptance, and regulation. As nations grapple with these challenges, the global impact of DeFi becomes more pronounced, setting the stage for a new financial era.

The Promise and Challenges of DeFi

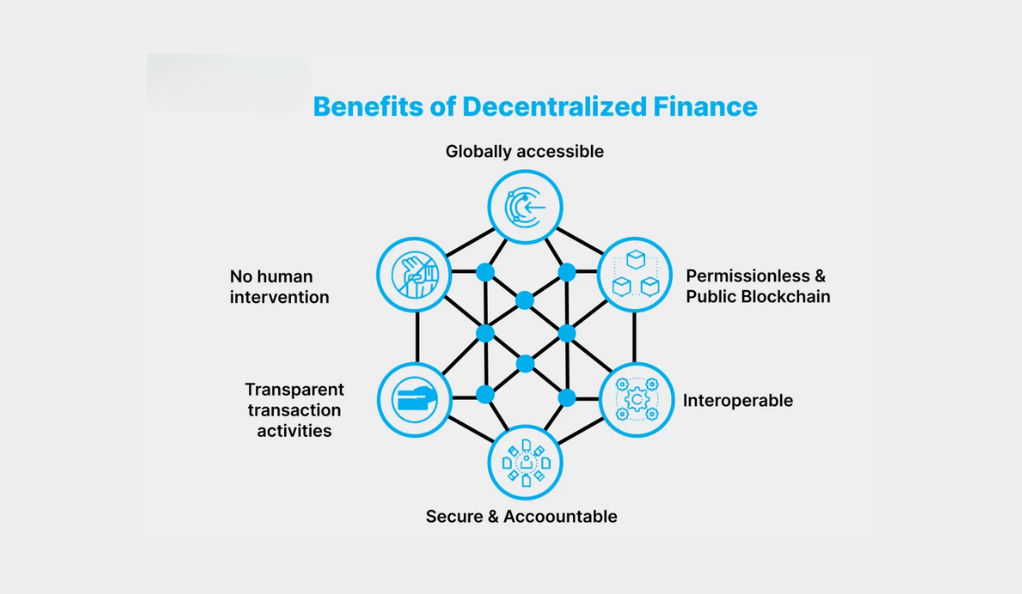

Benefits of Decentralized Finance

The allure of DeFi lies in its transformative potential. By eliminating middlemen, transactions become faster and more cost-effective. For the unbanked populations of the world, DeFi offers a beacon of hope, providing access to financial services that were previously out of reach. Moreover, with its transparent and immutable nature, blockchain-based systems offer a level of trust and security that traditional systems often lack.

Concerns Surrounding DeFi

While DeFi’s potential is undeniable, it’s not without its pitfalls. The decentralized nature, although a strength in many respects, also poses challenges. Without centralized oversight, the risk of fraud and scams increases. Moreover, the technical complexity of DeFi platforms can be daunting for the average user, leading to potential misuse or loss of funds.

Regulatory Responses to DeFi

Embracing DeFi: Progressive Nations

Progressive nations like Switzerland and Singapore are not just observing the DeFi wave; they’re riding it. By creating conducive regulatory environments, they’re attracting DeFi entrepreneurs and innovators, positioning themselves as global hubs for blockchain and DeFi projects. Their approach is reminiscent of the early days of the internet, where forward-thinking nations fostered tech innovation and reaped the rewards.

The Cautious Approach: Nations on the Fence

Countries like the US and UK, with their established financial systems, are naturally more cautious. They’re in a delicate balancing act, trying to protect consumers and maintain financial stability while not stifling innovation. Their approach is characterized by extensive research, discussions, and gradual policy implementations.

This cautious stance, while sometimes criticized for its slow pace, is also a testament to the potential impact of DeFi. These nations understand that hastily crafted regulations can do more harm than good, and they’re taking the time to get it right.

Restricting DeFi: Conservative Nations

For conservative nations like China and India, the rapid rise of DeFi is met with apprehension. Concerns about financial stability, consumer protection, and potential misuse for illicit activities have led to stringent regulations or outright bans. While these measures might seem restrictive, they stem from a place of caution.

Beyond Financial Policy: Broader Implications of DeFi Regulation

Privacy and DeFi

The intersection of DeFi and privacy is a complex one. On one hand, blockchain’s transparent nature offers a level of traceability and accountability that’s unparalleled. On the other, the pseudonymous nature of blockchain transactions ensures that, while transactions are visible, the identities behind them remain obscured.

This duality poses both opportunities and challenges. While DeFi platforms can foster trust through transparency, they also raise concerns about potential surveillance and privacy breaches. As regulators grapple with these nuances, the debate around privacy in the DeFi space intensifies, reflecting broader societal concerns about data privacy and individual rights.

Security Concerns and Measures

In the digital realm, security is paramount. The decentralized nature of DeFi platforms, while offering numerous advantages, also presents unique security challenges. Unlike traditional systems, where a centralized entity is responsible for security, DeFi platforms rely on their underlying blockchain’s integrity and the robustness of smart contracts.

However, as the ecosystem matures, so do the threats. From smart contract vulnerabilities to sophisticated phishing attacks, DeFi platforms are in a constant battle to stay one step ahead of malicious actors. This dynamic landscape underscores the importance of continuous research, development, and user education.

Consumer Protection in the DeFi Space

The absence of intermediaries in DeFi is both its strength and its Achilles’ heel. Without traditional institutions to mediate disputes or offer consumer protection, users are often left to their own devices. This decentralized model requires a new approach to consumer protection, one that’s built on community governance, transparent protocols, and user education.

Regulators worldwide are in uncharted waters, trying to craft policies that protect consumers without stifling innovation. It’s a challenging task, but one that’s crucial for the long-term success and adoption of DeFi.

The Future of DeFi Regulation

The DeFi landscape is in a state of flux, with new innovations emerging at a rapid pace. As such, regulatory frameworks cannot be static; they must evolve in tandem. The challenge for regulators is to strike a balance between fostering innovation and ensuring consumer protection and financial stability.

Collaboration will be key. Regulators, developers, and users need to engage in open dialogues, sharing insights and crafting policies that reflect the dynamic nature of the DeFi space. While the path ahead is uncertain, one thing is clear: the dance between DeFi and regulation is set to continue, shaping the future of finance.

Conclusion

The DeFi revolution is more than just a technological advancement; it’s a societal shift. As it continues to reshape the financial landscape, the world watches with bated breath. The challenges are many, but so are the opportunities. As nations navigate this new frontier, the choices they make will shape the future of finance for generations to come. Whether you’re an enthusiast, a skeptic, or somewhere in between, the DeFi wave is one that cannot be ignored.

FAQs

DeFi refers to a financial system built on blockchain technology that operates without traditional intermediaries like banks. It offers services like lending, borrowing, and trading in a decentralized manner.

Some nations are wary due to concerns about security, fraud, lack of consumer protection, and the potential for misuse in illicit activities. It’s a new frontier, and with it comes uncertainty.

DeFi platforms use cryptographic methods, smart contracts, and other blockchain-based solutions to ensure security. However, like any system, they’re not immune to vulnerabilities and require constant vigilance.

DeFi offers financial inclusion, reduced transaction fees, democratization of finance, and more. It’s like giving financial power back to the people.

While DeFi offers numerous advantages, it’s unlikely to completely replace traditional banking soon. Think of it as an alternative, offering more choices to consumers.

At cryptofolds, our dedication is to provide impartial and trustworthy information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we are not in a position to provide financial advice, and we strongly urge users to engage in their own thorough research.

Read More

No Comments